The Greatest Guide To Accountant Lincoln

Wiki Article

3 Simple Techniques For Accountant Lincoln

Table of ContentsSome Of Accountant LincolnNot known Details About Accountant Lincoln 10 Easy Facts About Accountant Lincoln ExplainedNot known Details About Accountant Lincoln Examine This Report on Accountant Lincoln

Idea While some accounting companies focus on niche services such as tax approach, the majority of will supply bookkeeping as well as payroll services, tax obligation preparation and also service valuation solutions. Tax Obligation Planning as well as Preparation There is a lot more to strain planning and prep work than completing income tax return, although accountancy companies prepare both state and also federal company tax obligation returns.Entrepreneur can likewise give audit companies authority to stand for the service proprietor's passions pertaining to notices, information requests or audits from the Internal Income Service (IRS). Additionally, entrepreneur need to develop business entities that develop most positive tax obligation scenarios. Audit companies aid recognize the very best remedies and also that help in the creation of entities that make the ideal tax obligation sense for the firm - Accountant Lincoln.

Yet entrepreneur aren't always professionals at the monetary elements of running a company. Accounting firms can assist with this. Accountant Lincoln. Copies of company checking account can be sent out to accounting firms that collaborate with bookkeepers to maintain exact capital documents. Bookkeeping companies additionally develop profit and loss declarations that break down essential areas of expenses as well as income streams.

The Single Strategy To Use For Accountant Lincoln

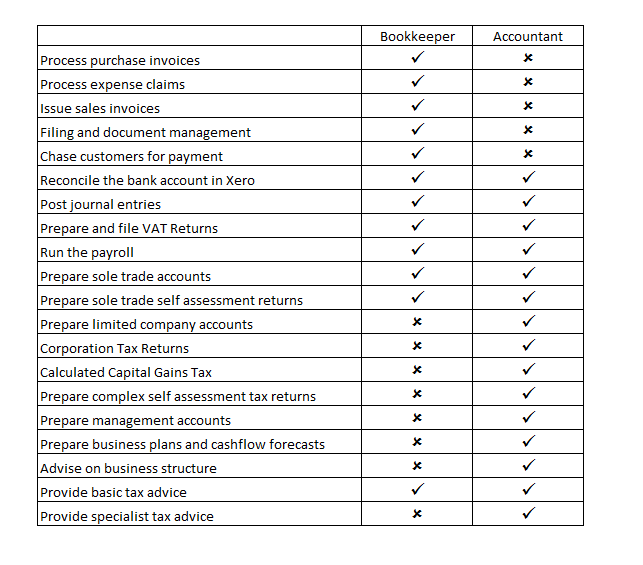

Accounting companies utilize industry information, in addition to existing company monetary background, to calculate the data.Whether you have actually recently set up a minimal company or you have been handling your funds separately previously, hiring an accountant may be the finest thing you do during the early days of running your company. Trying to supervise your business's accounting and also tax affairs can be tedious and demanding unless you have prior experience, and also can also take valuable time far from the daily running of the company - Accountant Lincoln.

What will your minimal firm accounting professional do for you?, Worth Included Tax, and registering your organization as an 'em ployer' (so you can run a payroll for the director and also employees).

Accountant Lincoln Things To Know Before You Get This

Service is arguably more vital as there's nothing worse than an unstable accounting professional. Before subscribing, figure out if you will have a dedicated factor of get in touch with. Some companies run a type of 'conveyor belt' system where you may not understand from day-to-day who to speak to if you have an inquiry.

What does an accountant do? An accountant's job is to keep complete records of all cash that has come right into and also gone out of the service.

Some Ideas on Accountant Lincoln You Need To Know

You can discover even more info on which deals require sustaining papers on the IRS site. There are no official educational demands to come to be a bookkeeper, yet they should be educated about monetary topics and bookkeeping terms and pursue accuracy. Normally, an accountant or proprietor oversees an accountant's work. A bookkeeper is not an accounting professional, neither must they be considered an accountant.

Based upon that estimation, choose if you need to work with somebody full-time, part-time or on a task basis. If you have complex publications or are generating a great deal of sales, work with a qualified or licensed accountant. A skilled bookkeeper can offer you assurance and self-confidence that your finances remain in great hands, yet they will additionally from this source cost you much more.

3 Easy Facts About Accountant Lincoln Shown

Tracy in his publication Audit for Dummies." [They] go back and also claim, 'We manage a whole lot of discounts, we manage a lot of vouchers. How should we videotape these transactions? Do I record simply the net amount of the sale, or do I videotape the gross sale quantity, also?' Once the accountant determines how to manage these deals, the accountant lugs them out."The accounting process creates records that bring key facets of your organization's funds together to give you a full photo of where your funds stand, what they suggest, what you can and also ought to do concerning them, as well as where you can expect to take your service in the near future.

Their years of experience, your state and also the complexity of your accounting requires impact the rate. Accounting professionals will either estimate a client a fixed cost for a specific solution or bill a basic hourly rate.

When to work with an economic specialist, It can be tough to gauge the proper time to hire a bookkeeping specialist or bookkeeper or to determine if you need one in all. While numerous small companies employ an accountant as a consultant, you have a number of alternatives for taking care of economic tasks. Some small business proprietors do their very own bookkeeping on software program their accountant suggests or uses, giving it to the accounting professional on a regular, month-to-month or quarterly basis for activity.

Report this wiki page